Barnes Associates wholesale monitoring survey finds accounts up 19 percent Michael Barnes suspects cableco/telecom influx could be behind ‘unprecedented growth’

By Leif Kothe

Updated Wed March 12, 2014

YARMOUTH, Maine—Much can be gleaned from the fourth annual Barnes Associates/SSN/CSAA wholesale monitoring survey, but if anything stands out about 2013, it's that overall growth was gaudy.

YARMOUTH, Maine—Much can be gleaned from the fourth annual Barnes Associates/SSN/CSAA wholesale monitoring survey, but if anything stands out about 2013, it's that overall growth was gaudy.

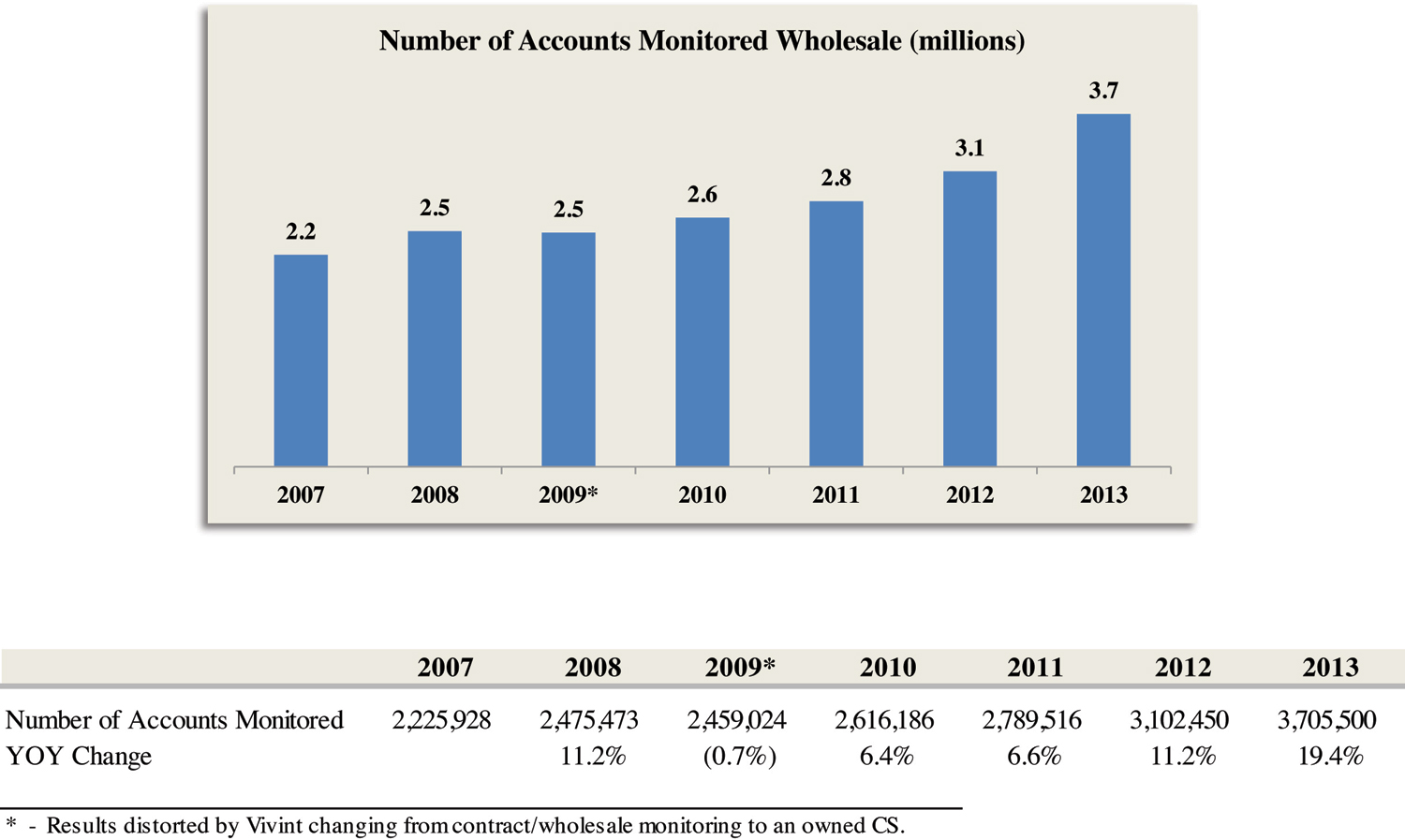

The wholesale monitoring segment enjoyed a 19.4 percent increase in the number of monitored accounts in 2013, according to a survey led by Barnes Associates, a consulting and advisory firm specializing in the security alarm industry. The survey was co-sponsored by Security Systems News and the Central Station Alarm Association.

Michael Barnes, founding partner of Barnes Associates, called the spike in year-over-year change “unprecedented. The survey from the previous year showed the year-over-year rate hovering around 11 percent in 2012.

“We were floored when the tally was complete and the wholesale monitoring segment was up by 19 percent,” Barnes said.

Over the past five years the survey [which has numbers going back to 2007] has shown account growth numbers ranging anywhere from strong (11.2 percent in 2008 and 2012) to negligible (0.7 percent in 2009 during the lows of the recession).

Needless to say, a 19 percent spike was a significant outlier. “Our first inclination was that we had some significant survey error,” Barnes said.

“The several larger participants that showed the most meaningful growth all received panicked calls from us questioning the results,” Barnes said. “They each assured us that they were correct, but would not offer any additional insight ... other than to say they had a tremendous year.”

It was no illusion. The account growth figures were very real. But the most intriguing question is why.

While nothing can be confirmed, the survey suggests that some of the giants of the wholesale space are monitoring accounts for several of the giants of the telecom/cableco arena.

“It took us a couple of weeks to realize that what we were seeing was the effect of the large cable/telecom players having success in the industry, many of whom are using wholesale monitoring providers,” Barnes said. “While nobody is talking, it is clear that these players are having a material impact.”

According to the survey, the majority of the increase was isolated to a handful of companies that were able to capitalize on the influx of these new market participants. The survey suggests that estimated growth—excluding the influence of these new players—was in the ballpark of nine percent in 2013, according to Spencer Rogers, vice president of Barnes Associates.

The survey participants, Rogers noted, monitor just over 3.7 million accounts, which is estimated to be about 16 percent of the entire U.S. market, according to the findings of the survey. By getting responses from some of the bigger names, Rogers believes the survey offers a good window into the state of the market.

“The top 100 players have about 55 percent of the market,” according to Rogers. “Coupled with the 16 percent of the market we can see through this survey, we have great visibility into over 70 percent of the industry.”

By segmenting the results and making informed inferences, Barnes said that they were able to “estimate for the first time what we think is the approximate size of these new, very large players.”

Barnes said that “as of the end of 2013, we believe [the cablecos and telecoms] have upwards of 500,000 alarm customers.” That, he explained, would be about half the size of Monitronics. He and Rogers estimated that the new players are adding “upwards of 20,000-30,000 new accounts per month … which is about the add rate of Vivint.”

Dynamark Monitoring and Security Partners, based in Hagerstown, Md., and Lancaster, Pa., respectively, each participated in the survey. Both companies enjoyed substantial growth in 2013, in both cases exceeding the average YOY account growth.

“We tripled our business,” said Keith Godsey, vice president of Dynamark. “We had a good year.”

Dynamark made a comeback to the wholesale monitoring space in 2011, after a lengthy hiatus. As with any comeback, there were difficulties in the early phases. But Godsey said the reentry struggles are now a thing of the past.

“The first year we opened, it was like 'Hey do you want to move your accounts to this brand new central station that has no accounts?' We had a couple of old friends that said, 'Yeah, why not?'” Godsey said. “But after we had that first year under our belt and performed, they told two friends and then they told two friends, and then people actually were calling us and saying, 'We want to move our accounts to you guys.'”

Godsey credits a customer-focused, personalized approach for adding a strong referral network element to the business. He also attributes the success in 2013 to market conditions that tend to favor the security industry at large.

The industry, he said, is reaping the benefits of a recovering—but far from recovered—economy. This engenders a climate in which businesses, in general, are on the upswing, but in which there's still some threat of crime, which can drive security sales.

“The economy's now recovering in some areas, which causes building and new spending, so right now it's almost a perfect world [for security],” Godsey said.

It's almost an understatement to say Security Partners had an active 2013. The Lancaster, Pa.-based company acquired two central stations in two different regions in 2013. In August, Security Partners bought San Antonio-based Response Center USA, and in December the company purchased Mace Central Station, based in Anaheim, Calif.

“We added two companies that doubled our size,” said Patrick Egan, CEO of Security Partners.

Discounting the acquisitions, Security Partners saw organic growth of 20 percent, Egan noted, adding that the company expects to maintain that rate in 2013. He attributes the robust internal growth, in part, to the success of the company's Advanced Services Division, which is “doing very well with managed access and managed video,” he said. “A lot of dealers are starting to embrace those services.”

Egan believes these types of video offerings are now the sine qua non for central stations. “If you think that your dealers are not going to ask or demand video, you're missing the boat,” he said. “You better be able to provide an integrated platform that will talk to anybody's network of DVRs or NVRs. You need to be able to provide everything from simple video verification to video tours to analytical video monitoring.”

Security Partners is also making major headway on the PERS front, Egan added.

While central stations are having to adapt to new technological demands, Egan believes the fundamentals of the industry have not changed. That bodes well for the industry as a whole—especially for centrals allied with the right dealers.

“I believe overall when you have aggressive, non-complacent dealers, there's enough business out there for everyone,” he said. “Customers are willing to pay a reasonable price for installation and a reasonable price for monthly service as long as you provide good service.”

Comments