ADT Q4 sees record-high retention, recurring monthly revenue

By Ken Showers, Managing Editor

Updated 11:51 AM CST, Wed March 1, 2023

BOCA RATON, Fl. – ADT Inc. has seen its fourth consecutive financial quarter results hit record highs as the company released its results on Feb. 28.

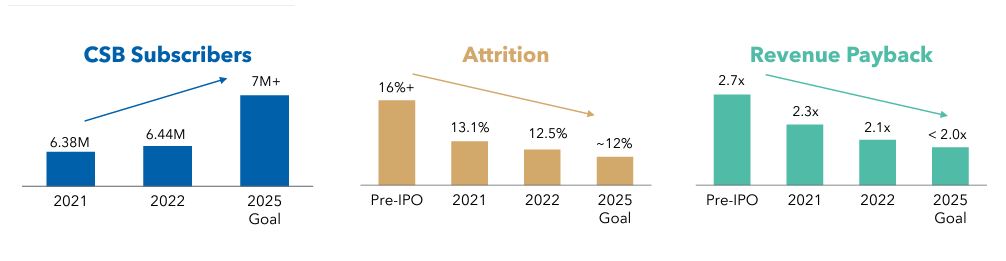

Of note the company pulled in a Q4 total revenue of $1.6 billion, up 19 percent from last year, 8 percent when excluding solar and end-of-period recurring monthly revenues. ADT also boasted record-high customer retention with a gross customer revenue attrition rate of 12.5 percent. The company’s total revenue was up 21 percent for the year, excluding solar.

“2022 was a very strong year for ADT. We delivered strong results with top-line growth while setting records in customer retention, recurring monthly revenue balance and revenue payback. Our results reflect the progress ADT is making as we shift from a traditional security company towards an innovative business poised for accelerating growth in new markets,” ADT President and CEO Jim DeVries said. “We concluded the year with positive momentum in our business, along with launching our partnership with State Farm and advancing our strategic relationship with Google. As we advance into 2023, we are forecasting solid growth in revenue, earnings and free cash flow, continuing our positive trajectory across our businesses and demonstrating progress on our 2025 goals.”

While DeVries does refer to the current economic environment as “challenging,” he cites the company's current business model as having demonstrated being recession resilient and credits its recurring revenue model for bringing in 70 percent of its total revenue. He also credited record high home improvement spending as a percent of disposable income for driving market demand for their products.

Finally, DeVries discussed the company’s burgeoning solar business, discussing the analysis and changes the business has undergone over the year to change and improve operation. That effort included the appointment of ADT’s Jamie Haenggi as Executive Vice President of Solar. “While these changes have improved results in ADT Solar, we know we still have work ahead of us to drive and sustain the level of performance, we expect this segment of our business to deliver.” DeVries said.

The CEO concluded by saying, “Our commercial business is thriving, and we have action plans in place to capitalize on the growth available to us in the solar market. We have a strong plan and commitment, to meeting both our 2023 objectives and the 2025 goals we laid out at Investor Day, just a year ago.”

ADT provided the following numbers for its 2023 financial outlook guidance, with all numbers representing an improvement over 2022: Total Revenue $6,600 - $6,850 Adjusted EBITDA $2,525 - $2,625 Adjusted Free Cash Flow $525 - $625.

For the full report you can visit investor.adt.com.

Comments