NAPCO announces record-breaking Q4 fiscal results for 2022

By Ken Showers, Managing Editor

Updated 1:25 PM CDT, Mon August 29, 2022

AMITYVILLE, N.Y. – Security device manufacturer and designer NAPCO Security Technologies has announced record-breaking fiscal results for the fourth quarter of 2022.

The company boasted results of a 22 percent increase of sales to $43.2 million, a recurring service revenue increase of 36 percent to $7.5 million, and an adjusted EBITDA increase of 29 percent to $9.2 million. Net sales increased 26 percent to a record $143.6 million, with a record net income increase of 27 percent to $19.6 million.

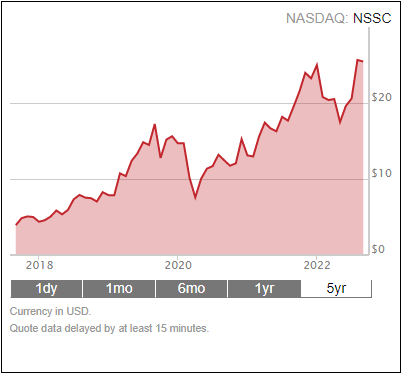

Stock prices for the company were at $19.26 this time last year and are closing now at $28.55, an impressive gain that has seen financial advisors praising the value of the company as an investment.

"Our record-breaking fourth quarter of fiscal 2022 generated strong revenue growth, as we once again achieved the highest sales for any quarter in the Company's history, $43.2 million, representing a 22 percent increase over last year,” NAPCO Chairman and President, Richard Soloway, said. “Both equipment revenue (up 18%) and recurring service revenue (up 33%) contributed to the year over year quarterly sales growth. This was the seventh consecutive quarter of year-over-year overall sales growth. Our recurring service revenues now have a prospective annual run rate of approximately $54 million based on July 2022 recurring service revenues. Gross margin for recurring service revenue continued to be very strong for the quarter, coming in once again at 87%. I was also very pleased to see our gross margins on hardware continue to show improvement, increasing 800 basis points to 27% for the fourth quarter compared to last quarter's hardware margin of 19%.”

Soloway mentioned that like most other companies that supply chain issues were affecting their hardware margins. “While we are pleased with the hardware gross margin improvement, we continue to work to restore margins to levels at or above those before the start of the supply chain crisis,” he said. “Toward that goal, we are developing alternative sources for those micros that are in high demand and which are key components in our Starlink cellular radios. In addition, as hardware sales increase, gross margins should improve as a result of increased overhead absorption rates in our Dominican Republic manufacturing facility resulting from higher hardware sales levels.” The Council of Supply Chain Management Professionals found in its 33rd annual state of logistics report that logistic costs rose by 22.4 percent to $1.85 trillion last year, representing 8 percent of 2021’s $23 trillion GDP.

NAPCO’s full statement about its Q4 fiscal results can be found at investor.napcosecurity.com.

Comments